Does the greenback still reign supreme in today's global economy?

| From the desk of Miles Everson: Hi, everyone! I hope you’re all having a great Wednesday. For today’s article, I’m excited to share with you a topic that has already been talked about many times in the past but is still worth repeating. I believe this is something we all have to keep in mind always. Are you ready? Continue reading below to know more. |

Does the greenback still reign supreme in today's global economy? Do you agree that the world runs on America’s currency—the U.S. dollar? I do. I’m not saying this because I’m biased or I’m American; I’m saying this based on facts. Think about these: It’s been that way since the end of World War II and the signing of the Bretton Woods Agreement… As of 2023, central banks across the globe held around 60% of their foreign exchange reserves in U.S. dollars. That’s three times as much as the closest competitor: The euro… The U.S. dollar is also the most widely used currency in international trade and financial transactions. It’s involved in nearly 90% of all foreign exchange market transactions… See? Its widespread use and the strength of the U.S. economy are reasons why people consider the U.S. dollar a “safe haven” in times of economic crises. … but despite all that, there have been rumors of the greenback’s potential downfall. Not long ago, China tried to promote the yuan as a global trade currency that could shake the U.S. dollar from its throne. There has also been recent talk about BRICS—an intergovernmental organization formed by Brazil, Russia, India, China, and South Africa—trying to come up with its own currency to replace the U.S. dollar. However, as we’ll discuss today, a recent report from the International Monetary Fund (IMF) on global capital flows shows the U.S. dollar isn’t going anywhere. In fact, the U.S. dollar and the U.S. economy are ripe for further investment. The U.S. Dollar is Still KING

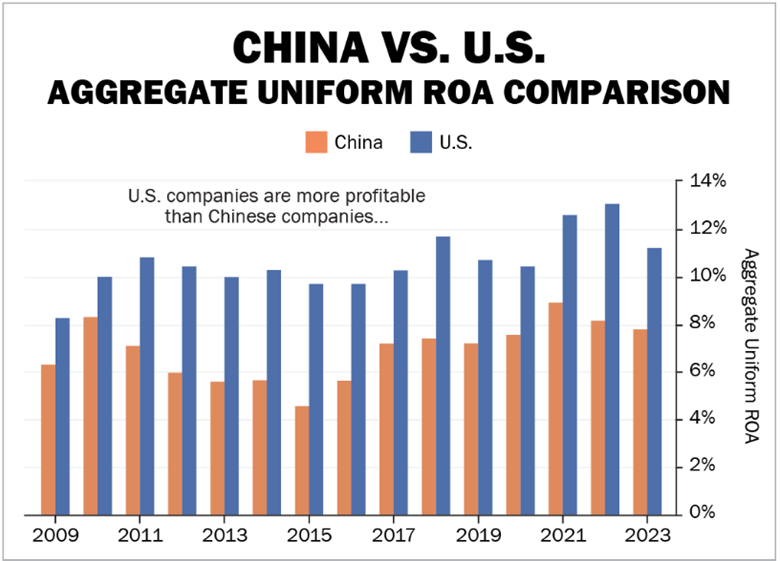

According to the IMF, one-third of the world’s capital has flowed into the U.S. since the pandemic. This means the U.S. is growing its position as the leading destination for foreign investments. More foreign investment and capital inflows = More trust in the U.S. economy and its currency On the other hand, China—the U.S.’ biggest competitor—is hurting from a lack of investment. Over the same period, China’s share of global capital inflows fell from 7% to 3%. According to Professor Joel Litman , Chairman and CEO of Valens Research and Chief Investment Officer of Altimetry Financial Research , one of the drivers behind the increase in capital flowing to the U.S. and away from China is interest rates . U.S. interest rates are at their highest level in the past two decades. Meanwhile, China has been actively lowering its interest rates in an effort to revive the country’s economy. Today, the U.S. government is still considered one of the safest investments in the world. So, if investors can get a higher yield from a safer investment, that’s what they’re going to do. What else? Professor Litman states U.S. corporations are still among the best in the world! Since 2009, aggregate Uniform return on assets (ROA) for U.S. companies has been higher than for China’s companies. Take a look at the chart below…

Clearly, the U.S. has been more profitable than China for 15 straight years… and it’s not slowing down anytime soon. It's easy to see why… For starters, the U.S. leads the world in oil and gas production. More and more countries are relying on the country’s energy industry as geopolitical tensions ramp up. Additionally, America heavily invests in its supply-chain infrastructure. U.S. companies are bringing their supply chains closer to home—in what is called the “supply-chain supercycle”—and it’s creating countless investment opportunities. What’s more? The U.S. is the world’s front-runner in artificial intelligence (AI) investments. In 2023, U.S. private investment in AI was roughly USD 68 billion. That’s more than double of the rest of the world’s investments combined! In particular, AI is a way for the U.S. economy to stay on top, especially with companies like U.S. chip giant NVIDIA (NVDA) , which managed to become the largest company on Earth in June 2024. The U.S. is still investing in AI. In fact, the country is spending billions of dollars on semiconductor plants, more data centers, and everything else that will continue to drive the AI boom. … and as an investor, you should know better that all of this should bring more investment to the U.S. dollar, not less. Hope you’ve found this week’s insights interesting and helpful. EXCITING NEWS AHEAD The world of work has shifted, and there’s no going back. The barriers to entry have never been lower for talented professionals to work independently, and today’s massive external workforce is hardly a pandemic-produced fad. Business owners can only survive in the new work landscape by partnering with this deep talent pool. With decades of experience in both small-business entrepreneurship and executive management at PwC, I truly believe that the future of work is independent. With that, I’m happy to share with you that my book, co-authored with Walter Scott Lamb, is now available on Amazon! Free Birds Revolution: The Future of Work & The Independent Mind This new bestseller is an essential read for both independent professionals and corporate executives. Here, we provide educational and practical guides to unpack the ever-growing workforce and offer you crucial ways to become a client of choice. Click on the link above to order your copy. Let this bestselling book help you future-proof your career and organization in the new world of work. Stay tuned for next Wednesday’s The Independent Investor! President Donald Trump’s agenda includes deregulation… and if he gets his way, investors will have more options when analyzing stocks. Learn more about GAAP-based financials in next week’s article! |

Miles Everson

CEO of MBO Partners and former Global Advisory and Consulting CEO at PwC, Everson has worked with many of the world's largest and most prominent organizations, specializing in executive management. He helps companies balance growth, reduce risk, maximize return, and excel in strategic business priorities.

He is a sought-after public speaker and contributor and has been a case study for success from Harvard Business School.

Everson is a Certified Public Accountant, a member of the American Institute of Certified Public Accountants and Minnesota Society of Certified Public Accountants. He graduated from St. Cloud State University with a B.S. in Accounting.