After years in the shadows, deepwater drilling is re-emerging for oil players.

| From the desk of Miles Everson: Hi! I hope your week is going well. I’m thrilled to talk about another investing insight for today’s “The Independent Investor.” Every Wednesday, I talk about investing strategies and tips in the hopes of helping you attain financial freedom through this activity. Today, let’s talk about a segment of the oil industry that’s now seeing meaningful investment after spending years in the shadows. Ready to know more? Keep reading below! |

After years in the shadows, deepwater drilling is re-emerging for oil players. After years of languishing in the shadows, deepwater drilling is seeing a resurgence as oil players are focusing on it again. The oil price crash in 2015 sent shockwaves through the oil sector, leading offshore projects to be seen as too expensive, with many believing they’d never be economical again. However, doubters are being proved wrong as companies have figured out how to make offshore rigs faster, more efficient, and less harmful to the environment. Thanks to this development, offshore drilling is seeing renewed interest in places like the Gulf of Mexico. Simply said, companies are spending big on deepwater drilling, creating opportunities for the players that endured years of waning interest in the sector. Offshore Drilling is Back in the Game Offshore drilling is seeing renewed interest due to the introduction of advanced technology leading to lower costs and improved efficiency. Take Shell ’s “Vito” platform in the Gulf of Mexico for example. The platform is a leaner, more advanced rig that produces the same output as conventional oil rigs at a fraction of the size and emissions. Chevron , with its “Anchor” platform, is pushing boundaries by unlocking reserves that were once inaccessible.

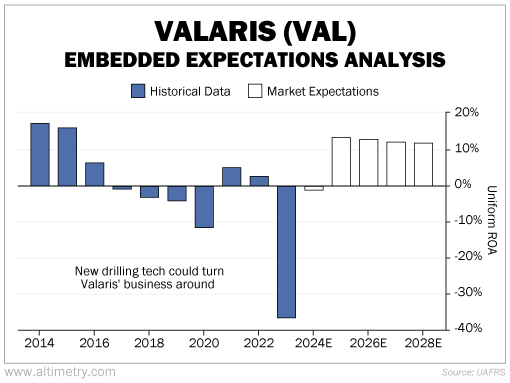

With offshore drilling seeing technological advancements and renewed attention, companies that operate and lease oil rigs finally have a chance to turn a profit. Case in point? Valaris , formerly known as Ensco Rowan . Valaris is a contractor that operates offshore rigs, leasing its platforms to oil companies. The company experienced remarkable performance prior to 2016, with its Uniform return on assets (ROA) reaching around 17% in 2014 and 2015. Unfortunately, the aforementioned oil price crash in 2015 dampened Valaris’ growth as demand for its rigs evaporated. It has struggled to stay afloat ever since. Valaris hasn’t turned a profit in years, with its Uniform ROA hitting its lowest point ever in 2023 at a negative 11%. A Lifeline As oil companies continue to invest in cutting-edge deepwater technology, demand for rigs will rise, putting companies like Valaris in a unique position to capitalize. … and investors seem to be catching on to this. According to Professor Joel Litman , chairman and CEO of Valens Research and Chief Investment Officer of Altimetry Financial Research , projections indicate a massive leap for Valaris in 2025, showing a dramatic turnaround from its previous performance. Based on his team’s Embedded Expectations Analysis (EEA) for Valaris, the company could see its Uniform ROA recover to 2014 levels—a turnaround that could transform the company’s prospects and stock price.

For those who might not know : The EEA enables Professor Litman and his team to calculate what investors can expect from a company’s future performance and compare those forecasts with their own research. Basically, the EEA tells them how a company has to perform to justify the market’s pricing for it. The Deepwater Renaissance is in Full Swing For the first time in years, offshore drilling is seeing meaningful investments and companies like Valaris are positioned to rip the benefits. While the industry’s turnaround won’t happen overnight, the outlook for it is improving as it gains traction. The turnaround in this sector presents an opportunity for investors to get in on a recovery that’s still in its early stages. As we see more investment in deepwater ventures, companies like Valaris could become one of the biggest beneficiaries. Hope you’ve found this week’s insights interesting and helpful. EXCITING NEWS AHEAD The world of work has shifted, and there’s no going back. The barriers to entry have never been lower for talented professionals to work independently, and today’s massive external workforce is hardly a pandemic-produced fad. Business owners can only survive in the new work landscape by partnering with this deep talent pool. With decades of experience in both small-business entrepreneurship and executive management at PwC, I truly believe that the future of work is independent. With that, I’m happy to share with you that my book, co-authored with Walter Scott Lamb, is now available for pre-order on Amazon! Free Birds Revolution: The Future of Work & The Independent Mind This is an essential read for both independent professionals and corporate executives. Here, we provide educational and practical guides to unpack the ever-growing workforce and offer you crucial ways to become a client of choice. Click on the link above to pre-order your copy. Let this book help you future-proof your career and organization in the new world of work. Stay tuned for next Wednesday’s The Independent Investor! Have you heard about the news that shook the global energy market in May 2024? Learn more about why the U.S. natural gas is here to stay in next week’s article! |

Miles Everson

CEO of MBO Partners and former Global Advisory and Consulting CEO at PwC, Everson has worked with many of the world's largest and most prominent organizations, specializing in executive management. He helps companies balance growth, reduce risk, maximize return, and excel in strategic business priorities.

He is a sought-after public speaker and contributor and has been a case study for success from Harvard Business School.

Everson is a Certified Public Accountant, a member of the American Institute of Certified Public Accountants and Minnesota Society of Certified Public Accountants. He graduated from St. Cloud State University with a B.S. in Accounting.