Here’s why investors like you shouldn’t panic heading into 2025.

Ready to know more? Keep reading below! |

|

Here’s why investors like you shouldn’t panic heading into 2025. Just two weeks before 2024 ended, Jerome Powell, the chair of the U.S. Federal Reserve , announced that the Fed would cut rates by another 0.25%. However, he warned investors that they should expect no more than two cuts in 2025. The result? Investors panicked, leading the S&P 500 to drop 3% in one day. What’s more? Investors are worried about persistent inflation and weaker-than-expected economic prospects for 2025. Despite these worries and the recent announcement about future rate cuts, nothing has changed in terms of how strong the economy is going to be in 2025. A Favorable Environment for Corporate Earnings Growth Since credit availability is finally improving, companies will be able to borrow and use that cash to invest in their operations.

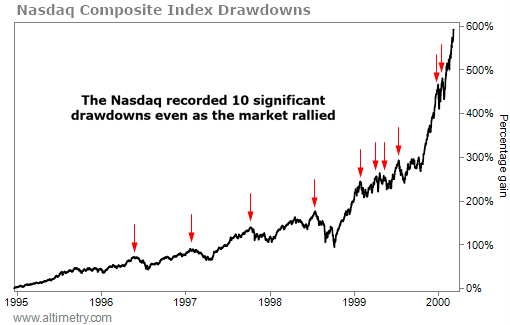

Moreover, with the incoming administration’s tax plans, corporations will have no excuse not to grow earnings this year. It’s natural to worry when stocks start falling, however, the last thing you want to do is sell when the market is primed for success. According to Rob Spivey, Director of Research at Altimetry Financial Research and Valens Research , today’s market resembles the early stages of the mid-to-late-’90s Internet boom. Since the launch of ChatGPT, the Nasdaq is up 68%... and Spivey says we’re still far from the best part of the market rally. The Nasdaq also went on to rally nearly 600% through the March 2000 market top.

Looking back, it’s hard to imagine why investors would want to get out of that market. … yet some did, as the Nasdaq fell 10% on 10 separate occasions over that five-plus-year period.

Each of those drawdowns would have felt like the market top at the time. Additionally, those who sold would have struggled to find a good place to buy back in. The bottom line? As long as the market has reason to grow, like it does today, the best step to take is to remain patient even when the market is volatile. Pullbacks Shouldn’t Be a Cause for Panic Even after the recent sell-off, valuations and investor sentiment remain bullish. As it stands right now, the key factors that drive the market such as limited debt head walls, improving credit availability, growing corporate investment, and a backdrop of deregulation and potential tax reductions, are all present. Hope you’ve found this week’s insights interesting and helpful.

Stay tuned for next Wednesday’s The Independent Investor! Are you familiar with Jackie Medcalf? Learn more about how one industry in America is fixing a ‘70s-era mistake in next week’s article! |

Miles Everson

CEO of MBO Partners and former Global Advisory and Consulting CEO at PwC, Everson has worked with many of the world's largest and most prominent organizations, specializing in executive management. He helps companies balance growth, reduce risk, maximize return, and excel in strategic business priorities.

He is a sought-after public speaker and contributor and has been a case study for success from Harvard Business School.

Everson is a Certified Public Accountant, a member of the American Institute of Certified Public Accountants and Minnesota Society of Certified Public Accountants. He graduated from St. Cloud State University with a B.S. in Accounting.

SIGN UP FOR THE NEWSLETTER

The Business Builder Daily

Newsletter Signup

We will get back to you as soon as possible.

Please try again later.